As organizations grow, the effective management of tangible, intangible, and leased assets must be aligned with both short and long-term business plans to meet strategic objectives. Oracle’s Enterprise Planning and Budgeting Cloud Service (EPBCS) Capital Asset business process addresses these needs and enables informed decision making through a user-friendly tool that is based on industry leading practices.

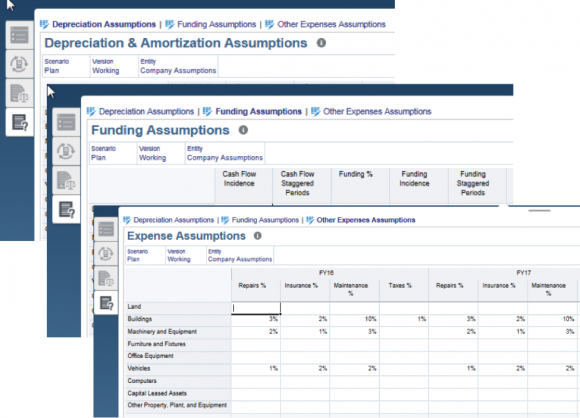

Businesses need a real-time view of forecasted asset expenses (operating and capital costs) as well as depreciation. The Capital Asset business process provides for planning and reporting in these areas at a department or project level. Planning functionality is streamlined using Oracle’s simplified interface and a driver-based model that offers users a single place to plan and report on asset information with ease. Flexible assumptions can be sourced or entered at a lower level department or at a higher, global level. Based on asset class, drivers assist in calculating operating expenses such as maintenance, insurance, and repairs. Depreciation is calculated based on useful life and the chosen depreciation methodology.

EPBCS Capital also has a new set of drivers to support funding values, deriving the cash flow impact of funding dollars:

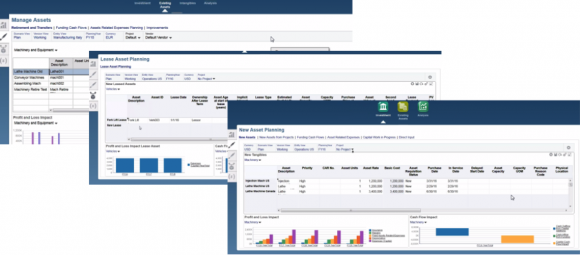

The Capital Asset business process builds upon the long established Oracle CapEx application module and adds new capabilities to manage existing assets and request new assets for future strategic needs. Users can monitor existing assets to understand their impact to a financial plan of planned additions of new fixed and leased assets:

The Capital Asset business process still provides timesaving features such as the ability to transfer assets across departments and to reconcile new assets with existing assets.

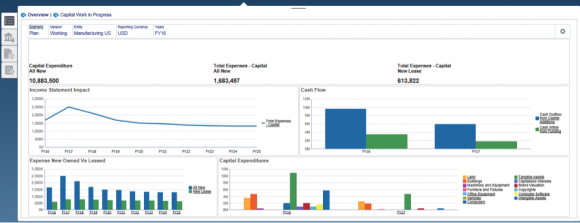

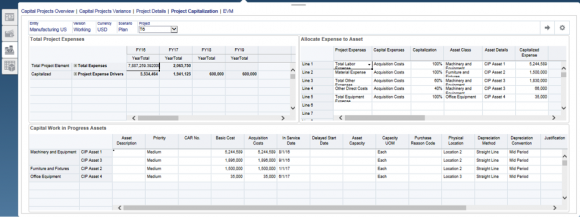

The consistent functional approach across Capital Asset and other EPBCS business processes such as Workforce and Projects strengthens user adoption. As an example, in addition to department-level planning, the Capital Asset business process enables users to plan Construction-In-Progress (CIP) capital projects. This Capital Asset business process is integrated with the Projects business process, where existing and new Capital projects send their capital expenses and assets to each associated project

New to the EPBCS Capital Asset business process, users can create multiple assets from a CIP project and can allocate specific funds of a CIP project to assets which then create multiple different assets that utilize different depreciation drivers such as depreciation method, depreciation convention, and useful life:

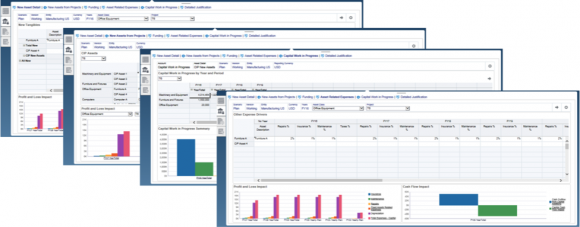

The Capital Asset business process also offers new analytical detail to help assess the financial impact of assets to a project by asset class and asset detail for tangible and intangible assets, as well as leased assets:

Interested in learning more? View our brief EPBCS Capital Asset demo video.